Despite fuel inflation, chip shortages, and geopolitical concerns, the Indian commercial vehicle market is maintaining its optimistic growth estimates for the current fiscal year given the favorable growth factors.

With an incredible 77% rise from April to August, the Commercial Vehicle (CV) market is off to a very good start. The bus segment led the resuscitation during this time, which was then followed by the segments for light and heavy commercial vehicles (M&HCV), intermediate and light commercial vehicles (I&LCV), and small commercial vehicles.

The industry indicators like OEM sales, consumption signals, freight demand, truck utilization and freight rates help us better understand the performance and health of the industry. We also look at the major trends that drive the CV and logistics industry.Â

Industry performance and health indicators, such as OEM sales, consumption signals, freight demand, truck utilization, and freight prices, aid in our understanding of the sector's health and performance. We also examine the key developments that influence the logistics and CV industries.

Strong double-digit growth was seen in the sales of medium and heavy commercial vehicles, which was caused by a rise in fleet utilization levels brought on by more robust economic and infrastructure-related activity. Tata, Ashok Leyland, and VECV reported increases in M&HCV sales that ranged from 42% to 51%. As more CNG-powered vehicles became popular, intermediate commercial vehicle numbers also increased by double digits, led by the e-commerce industry. Due to chip shortages, the small commercial vehicle market had a single-digit growth.

Demand for consumption: FMCG firms, who are reliable predictors of household demand, have reported a robust increase in sales during the first half of the year. The 2-wheeler and 3-wheeler markets have resumed growth, and most auto OEMs are currently experiencing considerable waiting periods for fast-moving models. The automotive industry has also had a strong start to the year. Along with agricultural products, parcel services and e-commerce are still expanding. After a protracted pause, consumption of capital goods such as mining, cement, and steel has now resumed, which is positive for operators.

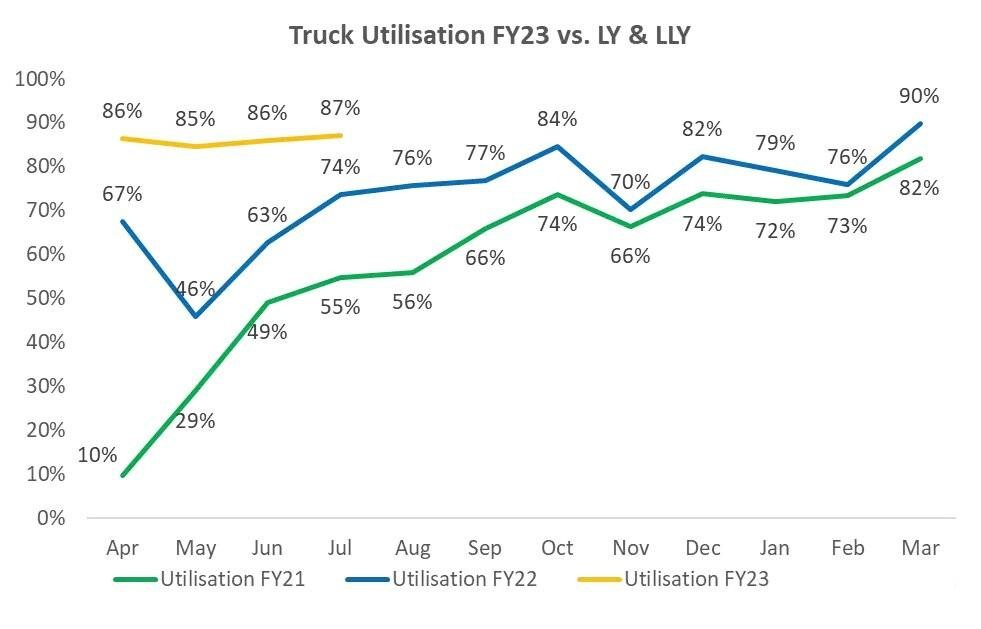

Truck Use: Truck use has additionally stayed high in FY23. In the initial 4 months of the year, Leaptrucks gauges use to have found the middle value of an exceptionally sound 86%. This is extensively higher than usage levels found in the beyond 2 years and has additionally crossed the use levels seen in Q4 last year. High usage levels guarantee that trucks invest more energy running and bringing in cash for administrators with low inactive time. This guarantees that administrators stay productive and monetarily solid.

OEM stock execution: Auto OEM stocks have all been ablaze as of late. Most businesses have been bullish on auto OEM stocks, particularly traveler vehicle OEMs since the majority of them are perched on huge delay purchases against effective new send-offs. Most OEMs with a significant CV presence either have an enormous presence in the vehicle portion like Mahindra and Tata Motors and Maruti, or like Eicher Motors that has a huge presence in 2-wheelers. The main pure-play CV OEM is Ashok Leyland which has returned 35% over the course of the last 1 year versus the BSE Sensex that has returned 2% in a similar period. Simultaneously, Eicher Motors has returned 26%, Maruti 30%, Tata Motors 59% and Mahindra a really great 76%. We accept that these stocks have still not calculated the genuine development expected in CVs in the ongoing evaluating.